Open banking available to everyone

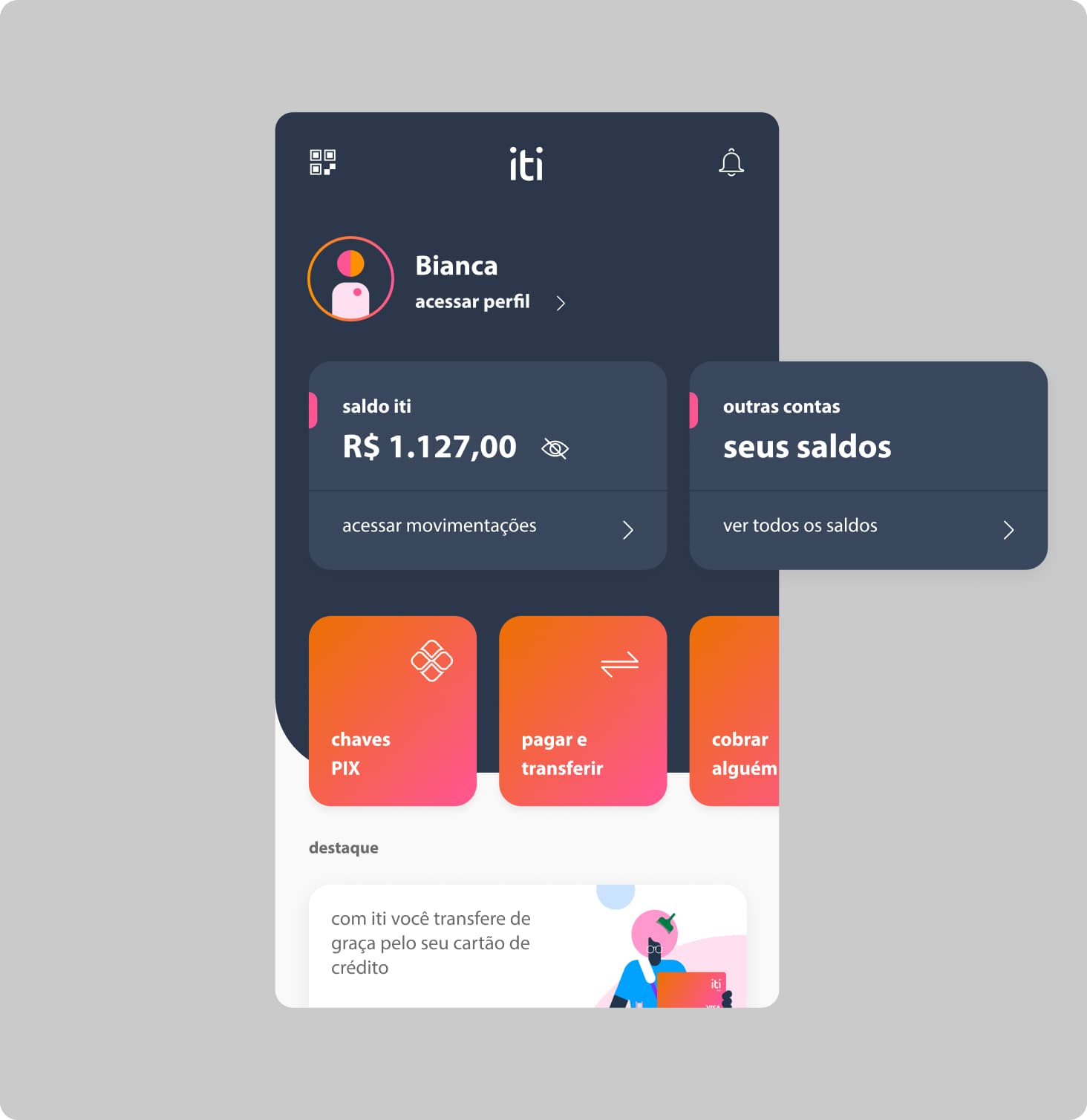

Iti is a digital bank powered by the biggest bank in Latin America: Itaú. The fintech’s goal is to provide credit and bank access to the 34 million people without a bank account in Brazil. With Open Finance features and API available in November 2020, iti Itaú launched its resources to help their target audience: low income users.

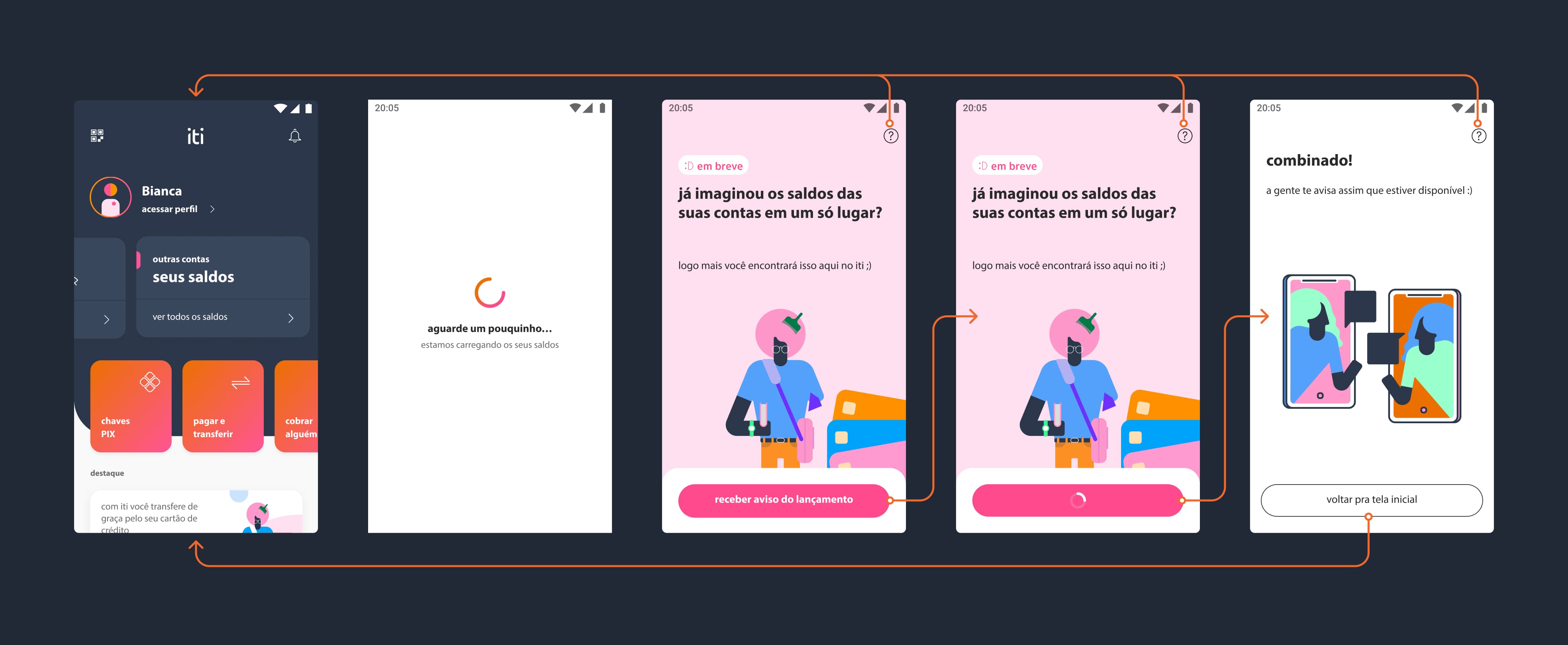

My role on the project was to define the user journey in collaboration with the larger team, create and adapt new components into the existing Design System and apply everything into a cohesive user interface.

Discovery

After the research phase was done, the team reached three key conclusions:

Multiple accounts

Brazilians often have multiple bank accounts to benefit from perks (zero fees, cashback etc...)

Low stability

Low income app users usually don't have a work contract, so they hold several different small jobs.

Disorganised finances

As a byproduct of holding multiple jobs and having multiple bank accounts, the users strugle to have a clear view of their finances.

Objectives & key results

The team started to define the OKRs and KPIs for the project, also thinking about the user’s pain points and opportunities available with the new Open Finance network.

OKR 1

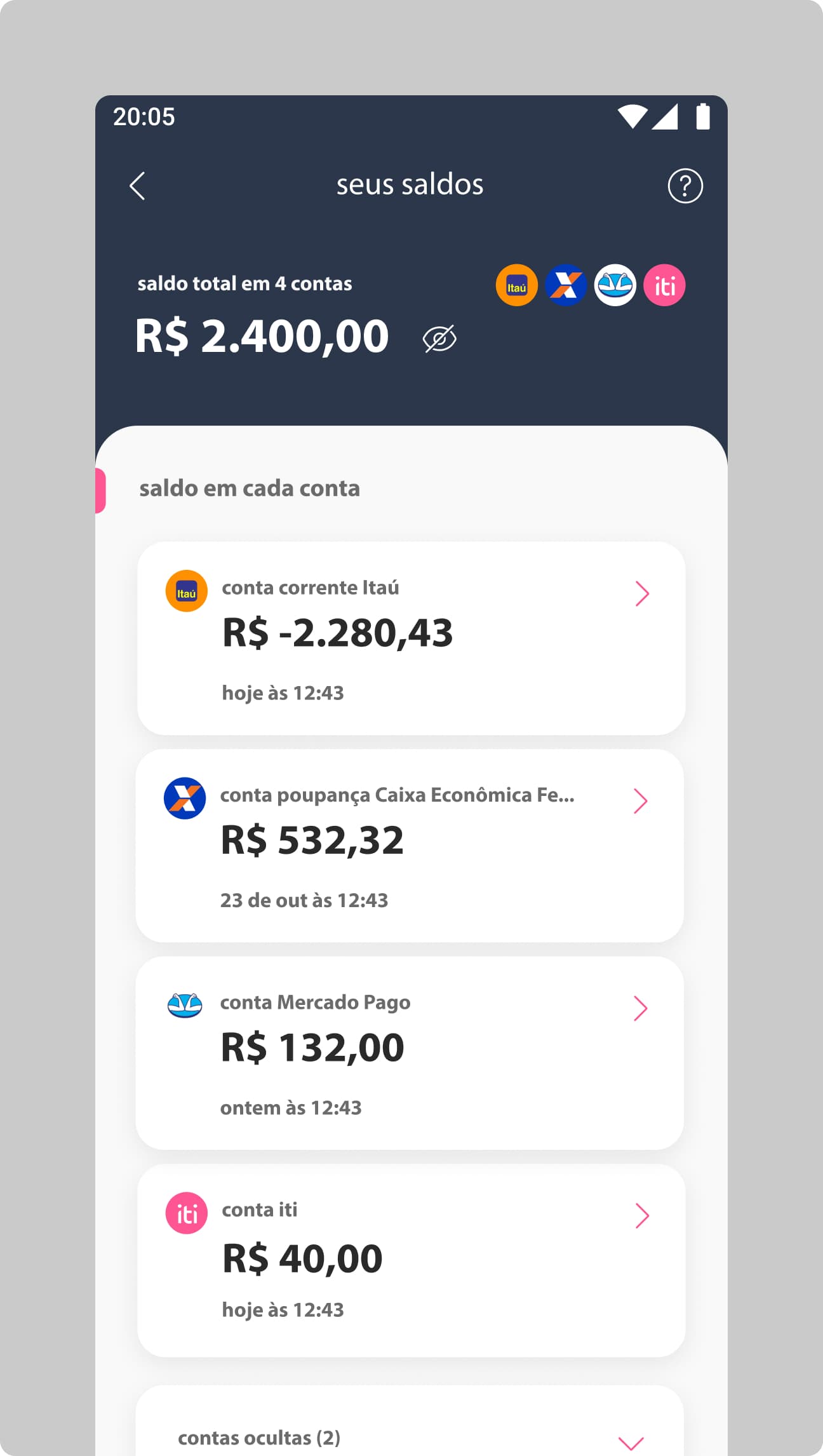

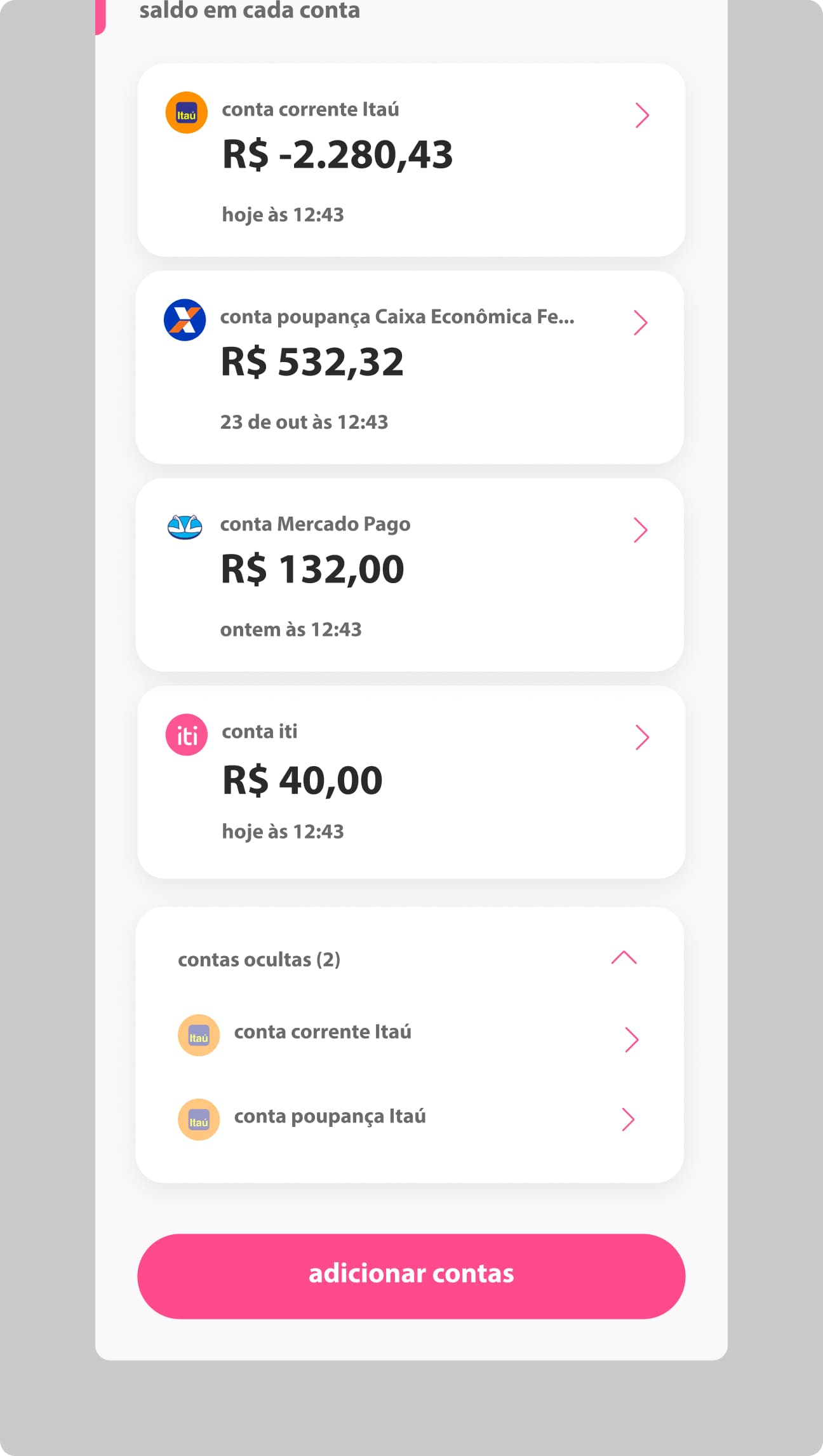

50% of potential audience viewing more than one account in their aggregate balance.

OKR 2

30% of monthly accesses from the target audience on Your Balances page.

KPI

Recurrence - To have users accessing the Your Balances page at least once a week.

Pain points

Our target audience has multiple accounts (average of 4) which leads to struggle in seeing their financial life as a whole.

Opportunities

Aggregate multiple balances (up to 10) using the Open Finance data sharing plus Itaú accounts.

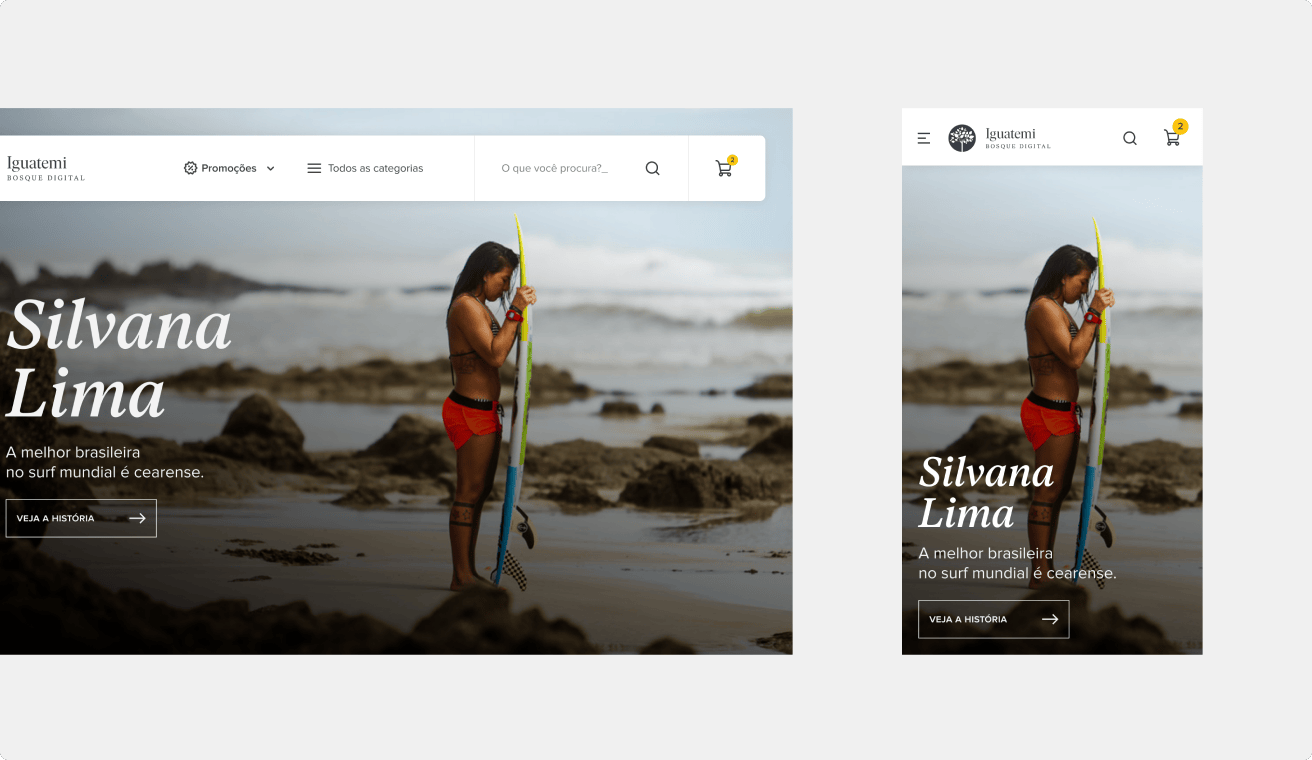

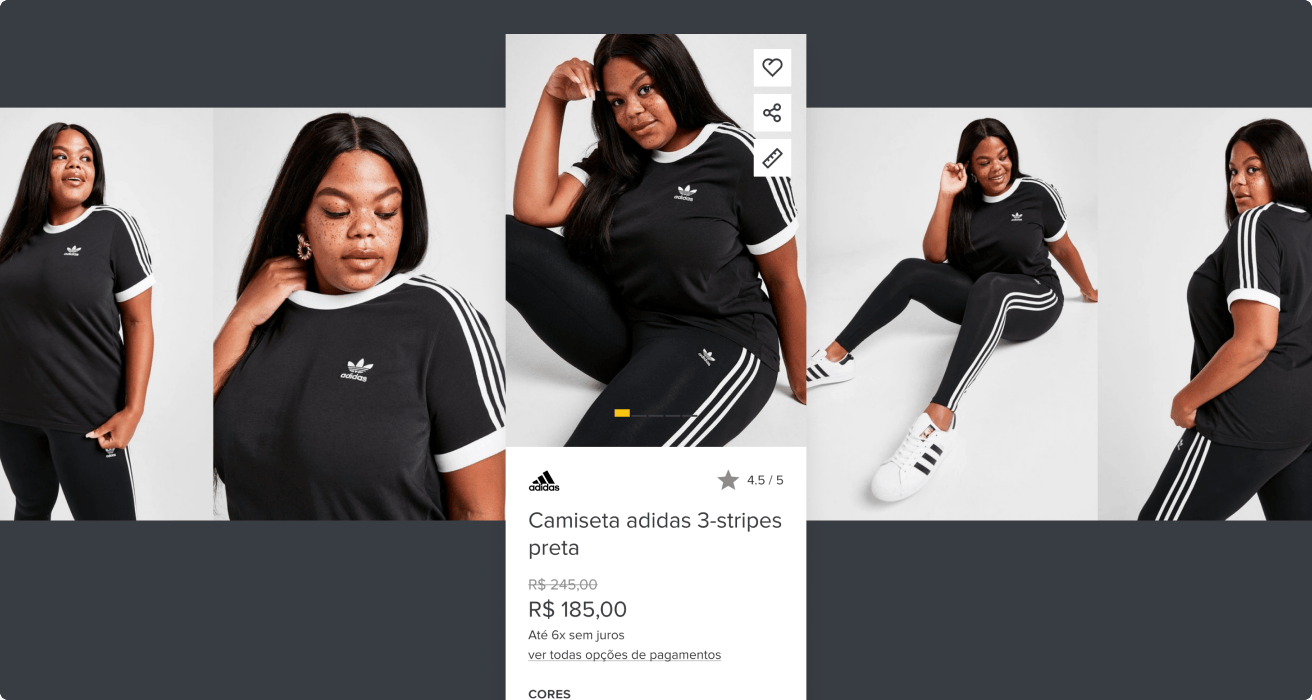

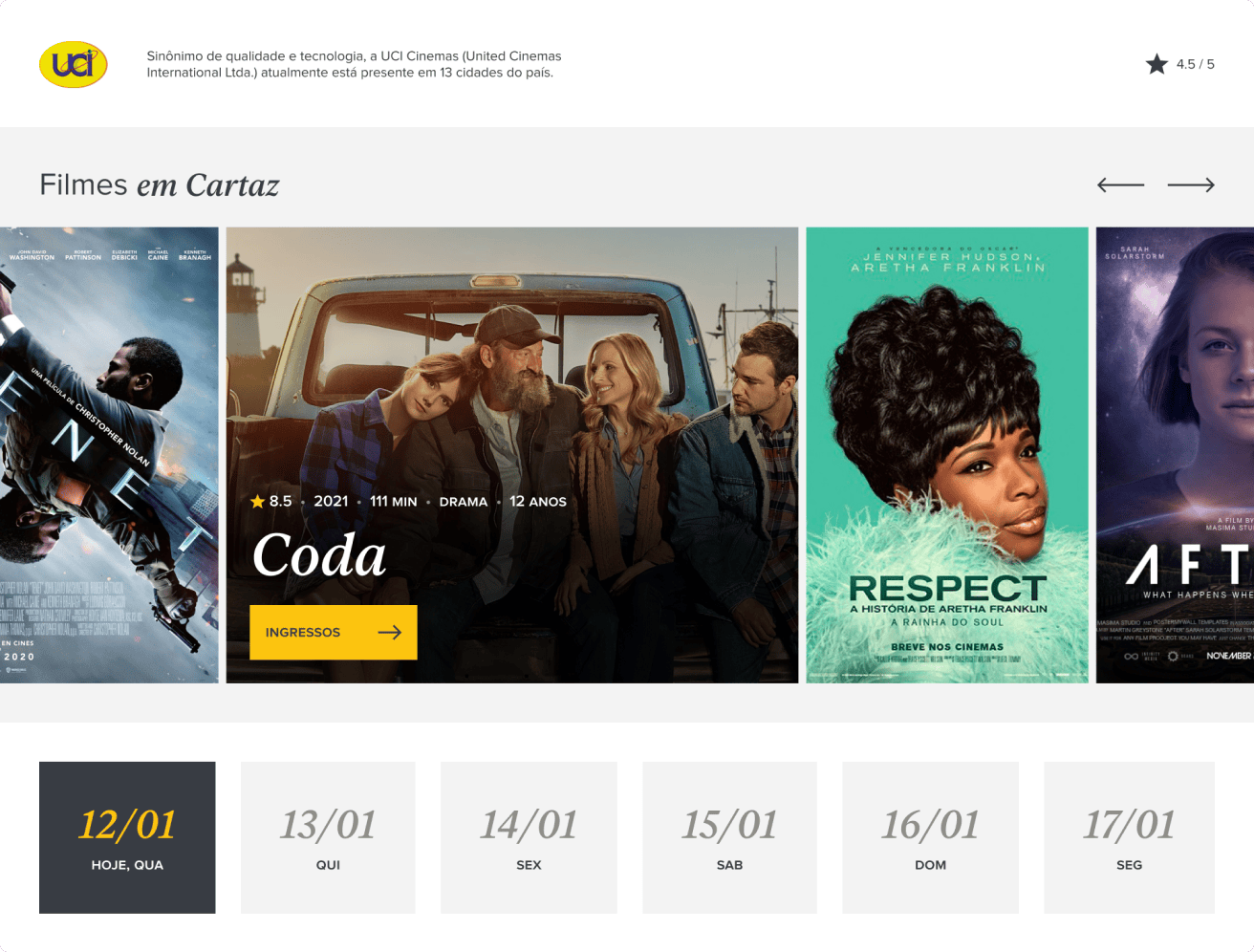

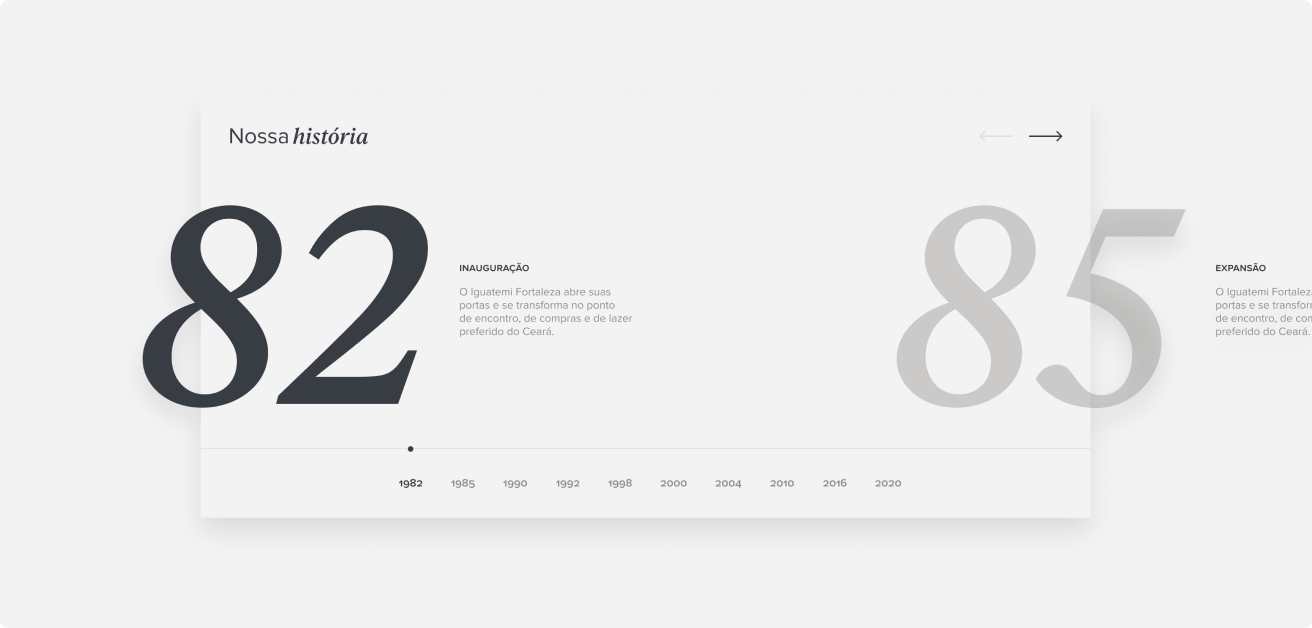

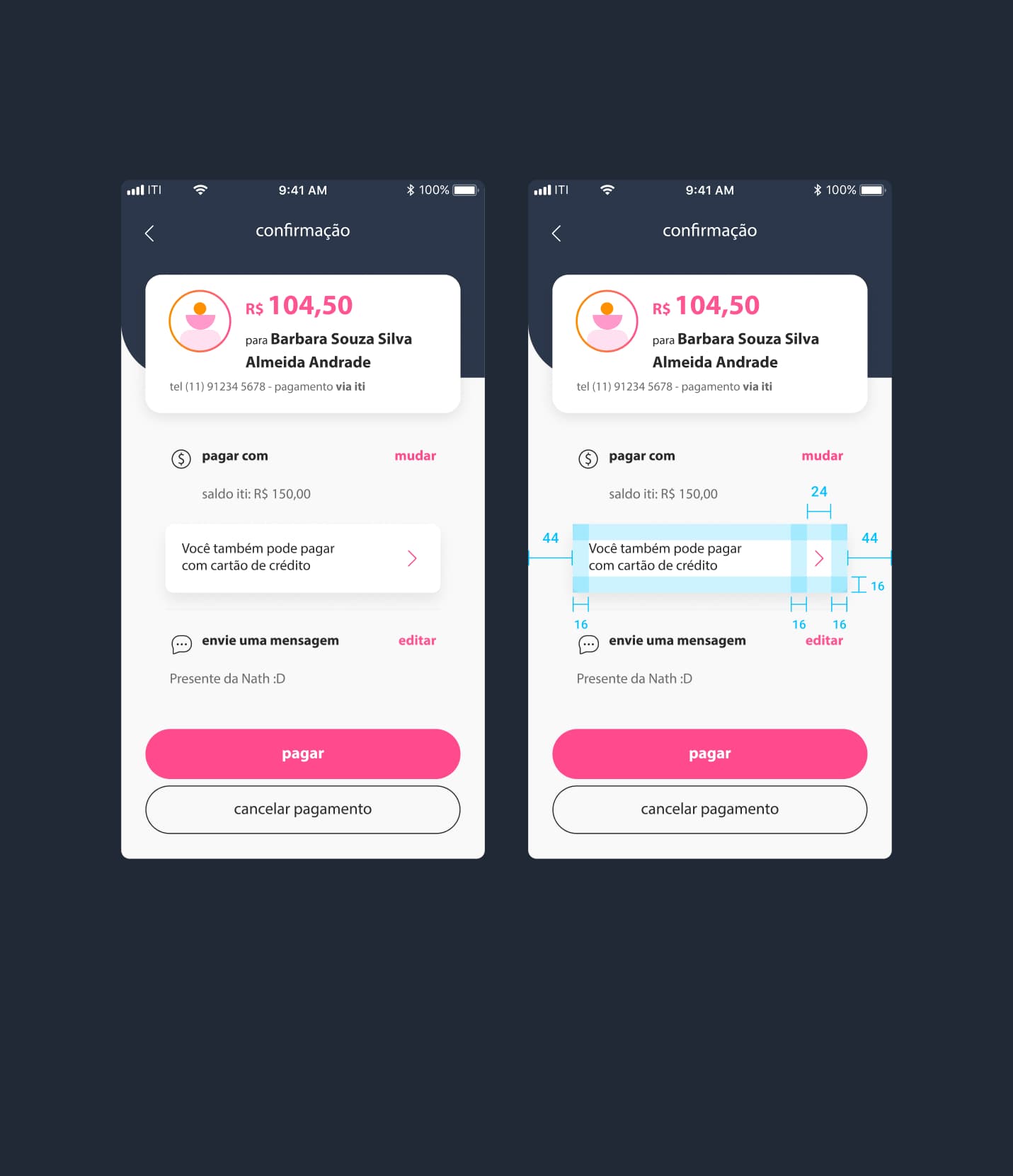

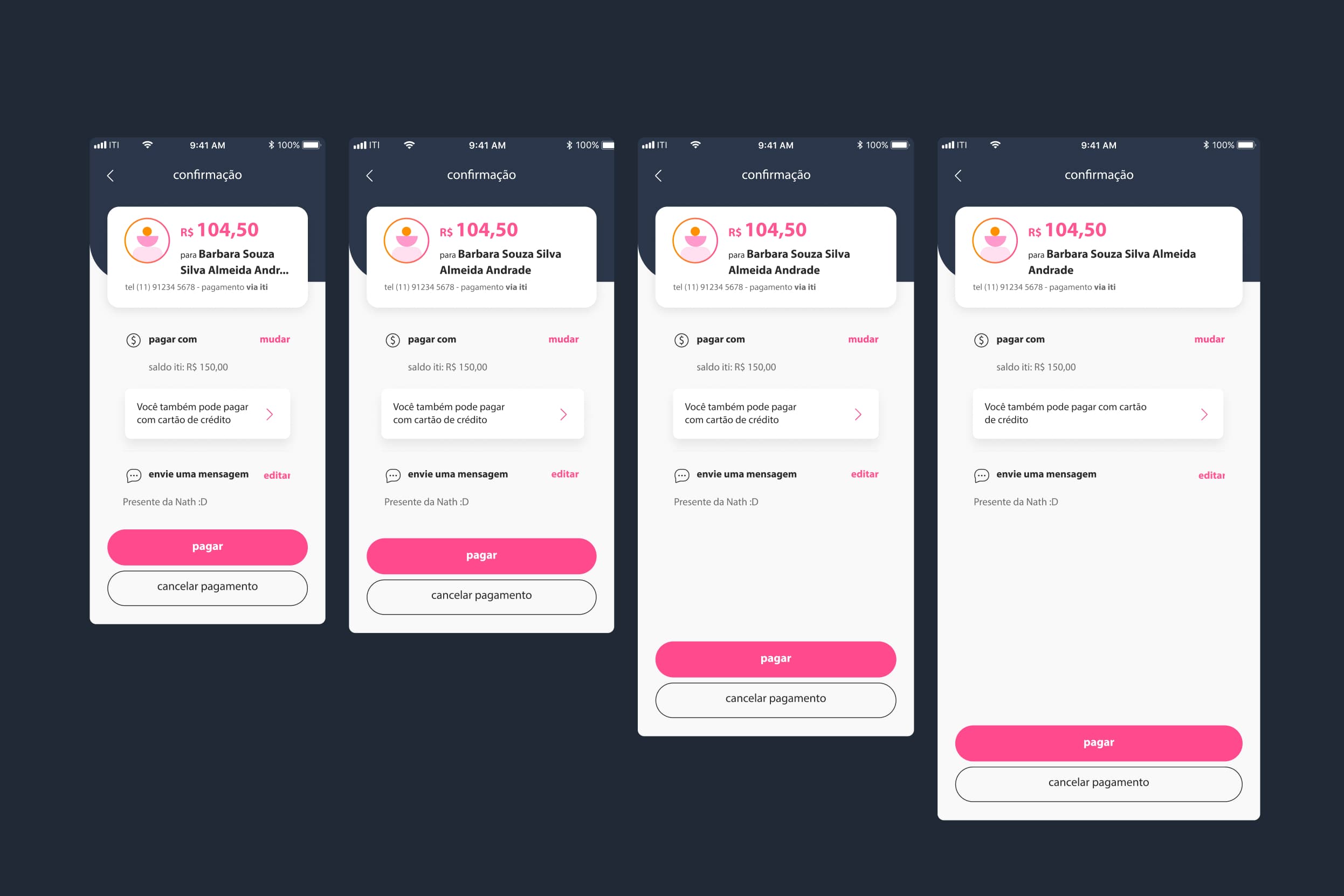

Specs for devs

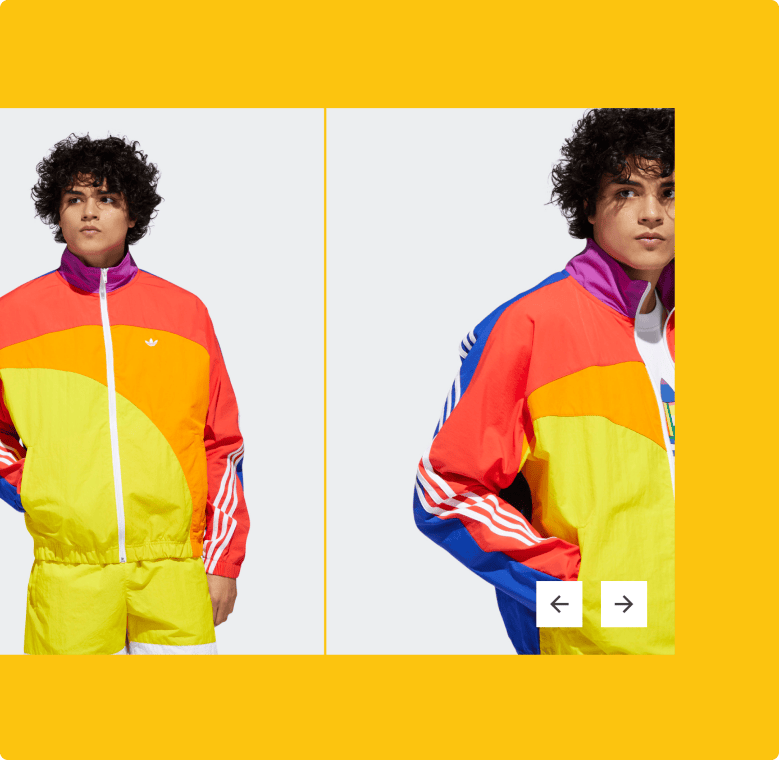

Responsive UI Testing

Features & context

Upon reaching a decision on objetives and results the team also mapped out the tasks users wanted to be able to perform, as well as the pillars for a user centric design.

User tasks

Primary task

• I want to know how much I have available in all my accounts

Secondary tasks

• I want to know how much I have available in each linked account

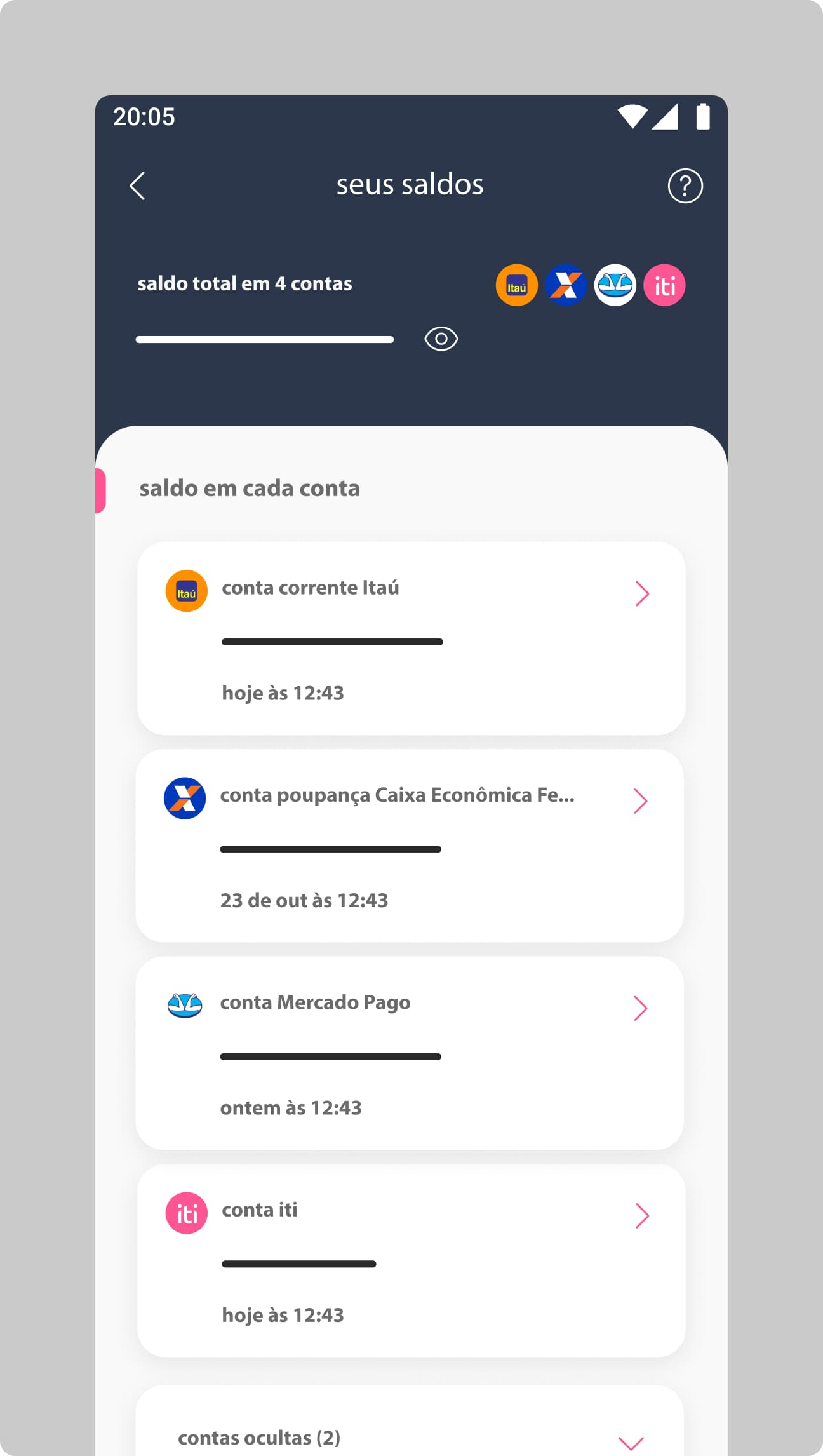

• I want to hide an account

• I want to give the account a nickname

Pillars

Refuge

Money is a taboo for Brazilians, tied to guilt, fear, shame, and temptation. It impacts their physical and security needs. We need a welcoming communication approach to prevent frustration with the provided information and indicators.

Low complexity

Our target audience does not show interest in more complex dashboards like GuiaBolso (brazilian app for tracking your financial health). It is important to have an intuitive interface.